DONOR RETENTION REVISITED: Fundraising Effectiveness Project Update

In February 2016 I posted an article entitled PLUGGING THE LEAKS: The True Impact of a 1% Increase in Your Donor Retention Rate. Since that was almost six years ago, I thought it high time to revisit the data. Many of you are well aware the news is not good on any of the donor-retention measurements. So, I’ll not belabor the point but briefly summarize some of the realities of the current nonprofit world. Then I’ll try to offer some perspective and constructive advice.

In February 2016 I posted an article entitled PLUGGING THE LEAKS: The True Impact of a 1% Increase in Your Donor Retention Rate. Since that was almost six years ago, I thought it high time to revisit the data. Many of you are well aware the news is not good on any of the donor-retention measurements. So, I’ll not belabor the point but briefly summarize some of the realities of the current nonprofit world. Then I’ll try to offer some perspective and constructive advice.

If you are all too aware of the bad news, you can fast-forward to MY PERSPECTIVE and STRATEGIC SUGGESTIONS below.

QUICK REVIEW

In 2006 the Association of Fundraising Professionals (AFP) launched the Fundraising Effectiveness Project (FEP) to conduct research each year on fundraising effectiveness—the source of my previous blog post. The AFP-FEP 2016 annual report was based on responses from 9,922 U.S. nonprofits that raised a combined total of $8.625 billion in the previous year (2015).

THE UPDATED STATS

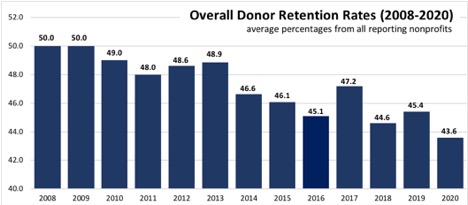

The Fundraising Effectiveness Project (FEP) has continued to monitor donor-retention rates each quarter since the initial FEP survey—the source of this article. The ongoing quarterly surveys show the following as the “average retention rates” across all surveyed nonprofits.

Source: Fundraising Effectiveness Project

1. The Overall Donor Retention Rate is the number of donors who gave in the previous year and gave again in the following year, divided by the total number of donors in the previous year. Only 46.1% of the donors who contributed at least once in 2014, contributed again in 2015. That reflects a 15-year trend—a slow but steady decline from a 50% retention rate in 2008. In the years since my 2016 article on donor retention, the overall donor retention rate has fallen to 43.6% in 2020. The inverse (a 56% donor-attrition rate) means that well over half the existing donors (first-time and repeat donors) did not give in the following year.

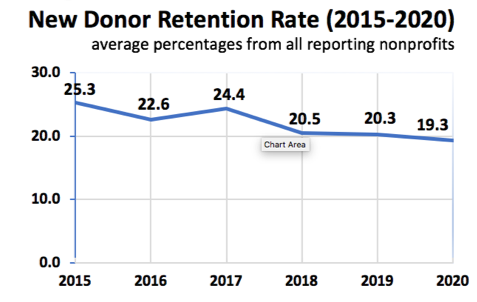

2. The Retention Rate for New (First-time) Donors in 2016 was 25.3% and, like the overall donor retention rates, has steadily declined to 19.3% in 2020. In other words, over 80% of the first-time donors the surveyed nonprofits attracted to their organizations in 2020 did not give in the second year, and the vast majority never gave again.

Source: Fundraising Effectiveness Project

Dr. Adrian Sargeant is the Robert P. Hartsook Professor of Fundraising at the Lilly Family School of Philanthropy at Indiana University. He wrote in the Nonprofit Quarterly, “It typically costs nonprofits two to three times more to recruit a new donor than that donor will give in their first donation. It can take twelve to eighteen months before a donor relationship becomes profitable.”1

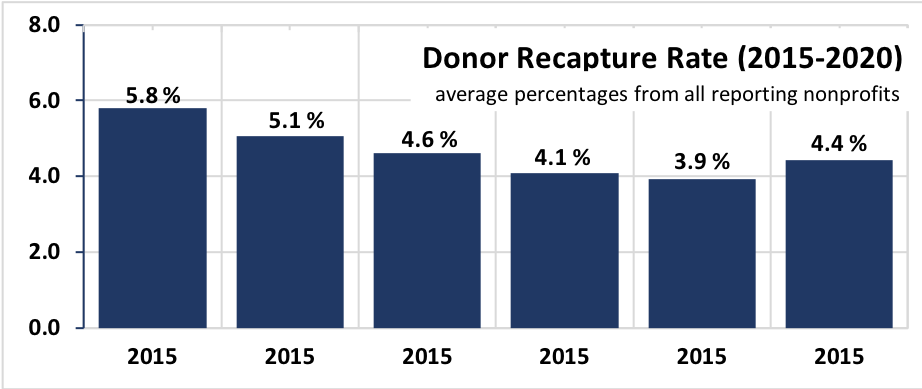

3. The Year-Over-Year (YoY) Recapture Rate is the percentage of donors who did not give in a succeeding year but gave again in the third year. In other words, they lapsed for a year but were “recaptured” as donors the following year. Trying to put a positive spin on a lost donor, some will say, “But we are confident they will give again.” Unfortunately, once they’re gone, they rarely come back. Among the 9,000+ reporting organizations in the 2016 FEP survey, only 5.8% of lapsed donors gave again in the succeeding year. That rate continued to decline to 3.9% then rebounded slightly to 4.4% in 2020.

Source: Fundraising Effectiveness Project

MY PERSPECTIVE

A comprehensive fund development program has a lot of moving parts, and it’s not easy to give all those parts the attention they need. Nonprofits can focus on program performance, unrestricted gifts, public relations, recruiting board members, or servicing a dozen other squeaky wheels. The year-over-year decline in donor retention rates is so small that you hardly notice the squeaking. However, donor retention has been on a steady decline for the last 15 years. It often goes without attention or concern when evaluating the immediate past or future. When looking at the big picture of organizational sustainability, it’s like a fire alarm going off in your organizational house.

I would like to say that all nonprofits are acutely aware of these trends. However, I’m not so sure they are. Since 2005, there’s been a hyper-emphasis on new-donor acquisition. Increasingly, new-donor acquisitions are what performance metrics measure and reward—rarely the more significant impact of donor retention. How few times have you heard of promotions or outstanding performance reviews that were based primarily on a fundraiser’s ability to keep current donors enthusiastic and engaged?

Short-sighted leadership decisions can also compound the problem. As strange as it may sound, many organizations are dealing with the impact of low donor-retention rates by either reducing development staff or redoubling their efforts on new-donor acquisitions. There seems to be a correlation between the declining donor-retention rate and declining development staff-per-major-donor.

An unfortunate trend among nonprofits is that donor relationships have become increasingly non-personal—organizational communications are pushed out in the form of emails, blogs, social media posts, as well as highly sophisticated direct-mail appeals. While these forms of donor-communication updates may be expected and necessary in the electronic world of mass media, lots of studies show they are a grossly ineffective means of donor relations and donor retention. In July 2020 I posted an article on the OVER-RELIANCE ON ELECTRONIC COMMUNICATIONS. A few stats from that post:

- For every 1,000 broadcast emails delivered, nonprofits raised $45 (i.e. less than 5 cents per delivered email). 2018 M+R Benchmarks Report:

- Nonprofits raised $0.83 per website visitor in 2018. Overall, 1% of website visitors made a donation. 2018 M+R Benchmarks Report:

- 5% of overall fundraising in 2018 came from online giving (i.e. 91.5% came from other sources)—Blackbaud Charitable Giving Report.

Personal communications via Zoom as a temporary alternative is one thing; reliance on social media or broadcast emails for donor relations is a different thing altogether.

MY STRATEGIC SUGGESTIONS

Okay, enough of the bad news. Below are a few things you might consider:

SUGGESTION #1: Cultivate Habitual Givers. If a donor agreed to make a $2,500 gift, I might suggest setting up a $200 per month automatic recurring donation (totaling $2,400). I’m not concerned about the $100 the organization might lose over the next 12 months. I’m much more interested in the donor-retention trends.

The overall donor-retention rate in 2020 was 43%; the retention rate for repeat donors from the previous year was 60%, and the retention rate for new donors was a measly 19%. However, a 2017 benchmark study from the Association of Fundraising Professionals found that monthly recurring donors were retained at a rate that hovered around an astounding 90%. So, you’d think that nonprofits would do whatever they could to create a culture of habitual giving. That same study reported equally astounding statistics—that only 14% of nonprofits prompt one-time online donors to upgrade to a recurring giver during the donation process (i.e. 86% don’t even ask). The reality is that donors who try to set up online recurring gifts to nonprofits have a great many hurdles thrown up by the organizations they’re trying to support. In addition to name, address, and phone numbers, donors are required to include birthdays, names of spouses and children, bank account numbers, as well as reCAPTCHA photo selections to prove that they are a human. There are a lot of donors who simply dig their heels in and refuse to provide that kind of personal information.

Actually, the only benefit to the nonprofit of the online giving portal is that it enables a donor file and gift acknowledgment to be generated automatically without any person’s notice. But, it is much easier for donors to simply set up recurring payments to the organization using the bill pay function of their own bank. All their giving records are tracked and saved in the computer that can quickly generate annual giving reports rather than having to keep track of numerous donation receipts.

Whether the proposed gift is for $250 or $2,500, the same principle applies. In fact, the larger the gift, the more likely donors are to set up an automatic recurring donation. It’s much easier to continue making a smaller gift than an intentional decision to stop giving. In other words, you are cultivating habitual givers.

SUGGESTION #2: Solicit Gifts from Appreciated Assets. Approximately 3% of family wealth is held in cash accounts; the majority of the remaining 97% is in real estate and securities. Fundraisers who appeal almost exclusively for donations from the 3% pot are like the poor during the Depression—standing at the backdoor asking for leftovers or spare change—i.e. from their donors’ discretionary spending or giving.

Fundraisers who appeal almost exclusively for donations from the 3% pot are like the poor during the Depression—standing at the backdoor asking for leftovers or spare change—i.e. from their donors’ discretionary spending or giving.

Dr. Russell James analyzed data from 1,055,917 nonprofit tax returns (IRS Form 990) filed electronically for the tax years 2010-2015. What his study demonstrated was that the most significant predictor of future giving was the type of gift—gifts from cash or net worth. The greater an organization’s success at raising cash in a given year, the less total contributions it received in the following year. And, the greater success in securing gifts from net worth assets, the greater the total giving in the succeeding year. In other words, the type of gift (assets or cash) was the greatest predictor of future giving and by implication, the best predictor of donor-retention rates for new and existing donors. Dr. James comments on a possible reason for the surprising correlation.

“When donors make non-cash charitable gifts (especially first-time gifts from assets), their gift opens the door to a wide range of giving possibilities. Their response to a future solicitation might be to consider a dozen ways to give rather than the one way—cash from their 3% pot of disposable income.”2

Soliciting donations of non-cash assets is in most cases a win-win for both donors and nonprofits, especially with gifts from retirement accounts subject to minimum distribution requirements and/or from appreciated assets subject to capital gains taxes. Yet, it’s baffling to me how frequently I come across organizations that solicit only cash donations from discretionary spending. I’ve made the case for charitable giving from appreciated assets since 1981 when, as a young fundraiser, the Chief Development Officer at Pomona College outlined it for me on a napkin. Consequently, my standard ask is always followed by a suggestion of gifts of net worth.

SUGGESTION #3; Aim for a One Percent Increase. For nonprofits with annual revenues of $5 million or more, the average value of a 1% increase in the donor retention rate for a given year would (on average for the surveyed nonprofits) result in $186,873 additional income in the following year (and more for significantly larger organizations). However, that’s only a fraction of the true value of a 1% donor retention rate increase because it only calculates the impact in the following year. It does NOT account for the Lifetime Value of a Donor—that is, the cumulative impact of a retained donor’s giving throughout future years.

That same compounding effect can work either for or against your organization. Think about this: The FEP report revealed that both the repeat-donor retention rate and the new-donor retention rate was a negative 1% in each of the last eight years. Considering the financial impact of that negative 1% per year change in the donor-retention rate, the compounding curve is working against many nonprofits. See PLUGGING THE LEAKS: The True Impact of a 1% Increase in Your Donor Retention Rate.

SUGGESTION #4: Never Take Previous Donors for Granted. Rarely do donors announce their intention to stop giving. For whatever reason (and there can be many), they just stop. By the time anyone notices, they are giving elsewhere or nowhere at all. The recapture rate for lapsed donors has also been in a steady decline and is now below 5%. I am, however, reminded of a lesson I learned from my first fundraising job.

That is only a fraction of the true value of a 1% donor retention rate increase because it only calculates the impact in the following year. It does NOT account for the Lifetime Value of a Donor—that is, the cumulative impact of a retained donor’s giving throughout future years.

Since I was the new guy, my workspace was in a third of what was once the dining room in an old house. A stack of donor files that no one else wanted sat on an old green metal desk, which probably came from Army Surplus. I was awarded the responsibility for these donors and with a half-laugh, my boss said, “You’ll never get anything out of these people, but that’s your first job. Go get ‘em.”

He seemed to suggest that unburdening more experienced professionals of these old files was accomplishing a great feat.

It didn’t take long for me to figure out that motivating donors to give once they decided to quit is a hard sell—so much so that I simply stopped asking for more gifts and began to focus on thanking donors for what they had done in previous years and how far the university had come as a result of those very donations. I realized years later that many of these files represented strategic donors—people who ask a lot of questions, who place a high premium on trust and relationships, and who are as careful about their giving as they were their spending. In other words, these donors are suspicious at first, generous with established relationships and faithful to the end with their friends. One of the donor questions I’ve heard many times over the years is, “Will they still love and appreciate me if I stopped giving or could no longer give?” I was simply acknowledging some long-overdue appreciation for the part they had played.

Did I recapture lots of lapsed donors from those files? Probably no more than 5%, but I eventually worked my way through the stack of files and out of the dining room into my own office next door to the president. That was due in part to following up with one of those lapsed donors, which eventually led to one of the largest one-time gifts of my early career ($12.6 million).

* * *

I understand that nonprofit executives are not nearly as concerned about the state of the nonprofit world as they are for their own organizations. Yet, most are following the same strategies and experiencing the same downward trends. I encourage all of you to set a goal—to do whatever it takes to increase the retention rates of all segments of your donor base in the coming year.

Eddie Thompson, Ed.D., FCEP

Founder and CEO

Thompson & Associates

“If we merely aim for the industry standard, then our goal is mediocrity. Emulating the average nonprofit, we are destined to live with all the problems the average nonprofit faces. So, we suggest you aim to be exceptional in your approach to fund development.”

—Eddie Thompson

copyright 2022, R. Edward Thompson

1 Adrian Sargeant, “Donor Retention: What Do We Know & What Can We Do About It?” | August 15, 2013 | Nonprofit Quarterly

2 THE UNFORTUNATE FOCUS ON CASH: Donation Types as Predictors of Future Growth