January and February 2024 is the Best Time in Years to Fund a Traditional Charitable Gift Annuity

A note from Eddie: I am privileged to have known Laura Hansen Dean for almost 40 years and consider her one of the best gift planners around. Even if you don’t know Laura personally, you have likely heard her speak or read something she wrote. She currently serves as Advisor to the Assistant Vice President of Philanthropic Planning, Texas Development at The University of Texas at Austin. She was inducted into the National Association of Charitable Gift Planners’ National Hall of Fame in 2018 and has assisted with charitable gifts that total more than $1 billion. In this guest blog post, Laura explains why this is a great time to talk to people about a traditional Charitable Gift Annuity.

Guest Post by Laura Hansen Dean

January and February 2024 is the best time in years for donors to fund new traditional charitable gift annuities. Why?

Higher recommended charitable gift annuity rates are effective January 1, 2024. The recommended rates are the highest they have been for many years.

The federal midterm interest rate dropped from 5.8% for December 2023 to 4.8% for February 2024. I don’t remember the last time the federal midterm interest rate – also referred to as the Code section 7520 applicable federal rate – dropped a full percentage point in such a short period of time.

Remember, when calculating the charitable percentage and the tax-free percentage of payments for the rest of the annuitant’s average life expectancy, the AFR for the month the traditional CGA is funded OR the AFR for either of the two preceding months can be used. So, traditional CGAs funded not later than the end of February 2024 can use the December 2023 rate of 5.8% or the January 2024 rate of 5.2% or the February 2024 rate of 4.8%.

With traditional CGAs, the higher the AFR, the higher the charitable value percentage but the lower the tax-free percentage of the annuity payments for the annuitant’s average life expectancy. The lower the AFR, the smaller the charitable value percentage but the higher the tax-free percentage of the annuity payments for the annuitant’s average life expectancy.

The preceding paragraph does not apply to a one-time charitable gift annuity that is created through a QCD – qualified charitable distribution directly from the custodian of an Individual Retirement Account owned by an individual older than 70½. The maximum amount in 2024 is $53,000. A QCD charitable gift annuity does not result in a charitable income tax deduction AND all annuity payments are taxable income.

IF THE LARGEST POSSIBLE CHARITABLE VALUE IS THE PRIORITY FOR THE POSSIBLE DONOR, THEN CREATING AND FUNDING A NEW TRADITIONAL CGA BEFORE THE END OF FEBRUARY 2024 GIVES THE BIGGEST CHARITABLE VALUE PERCENTAGE. The Federal Reserve has indicated that 4 to 6 reductions in the inter-bank loan rate are likely in 2024. When the inter-bank loan rate drops, so does the AFR for charitable calculations eventually.

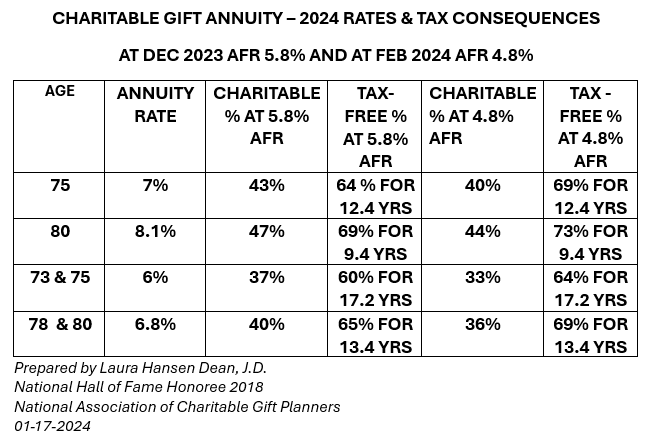

Below is a chart comparing the charitable value percentage and the tax-free payout percentage at different ages at 5.8% AFR and at 4.8% AFR.

Two important talking points when visiting with donors about traditionally funded CGAs to remember:

- VERY IMPORTANT TO REMIND DONORS VERBALLY AND IN WRITING THAT THE VERY ATTRACTIVE PAYOUT RATES ASSUME THAT ONLY 50% OF THE ORIGINAL GIFT VALUE WILL BE LEFT WHEN THE ANNUITANT OR SURVIVOR ANNUITANT DIES.

- IN SOME STATES THE ENTITY ISSUING THE CGA CAN OFFER LOWER PAYOUT RATES THAN THOSE ISSUED BY THE AMERICAN COUNCIL ON GIFT ANNUITIES. When a donor indicates they don’t need the CGA income but are not ready to make an outright gift in case they may need the CGA income in the future OR they want a larger projected residual amount, I suggest you prepare two traditional CGA illustrations (in states where a lower rate can be offered), one at the recommended payout rate and one at a lower payout rate. I have done this many times and have found that once such donors see the difference in the projected residual amount, many times they choose the lower payout rate – higher charitable value percentage with the higher projected residual amount left for the issuing charity.

Happy New Year,

Laura Hansen Dean, JD

Member, National Hall of Fame

National Association of Charitable Gift Planners